Startup of the Week: Profitus

2020

Jan 28

Jan 28

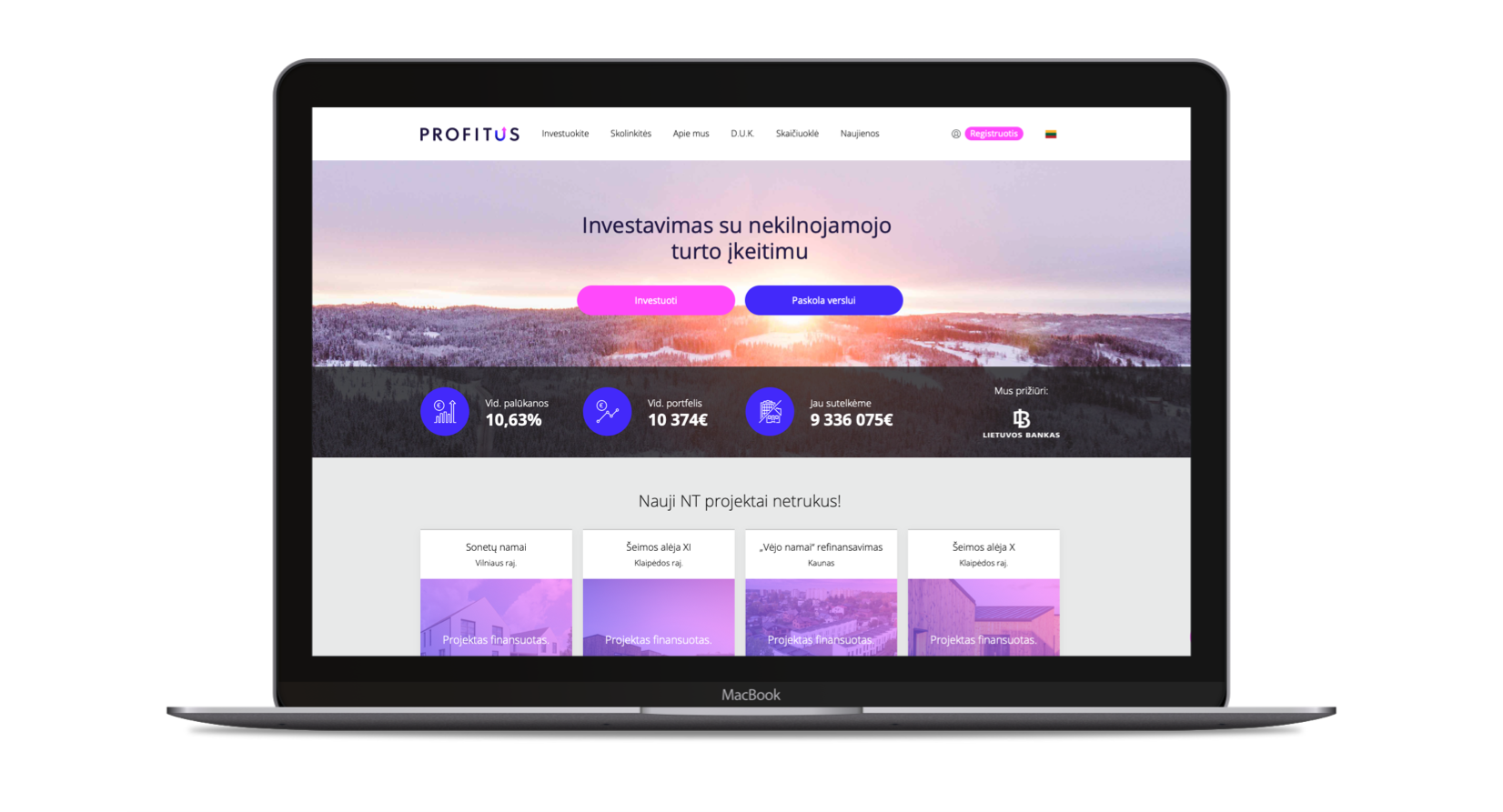

This week, Startup Lithuania is more than happy to represent one more well-known Lithuanian startup – Profitus. A technology-driven startup that runs crowdfunding and investment platform. In the interview, the founder of this startup – Viktorija Vanagė explains about competitive advantages, faced challenges and future ambitions of Profitus. The platform that has been operating for just over a year, crowdfunded 9.4 million euros and funded 55 projects in total. It’s a strong beginning for Profitus, which makes us even more excited about the future projects of this startup.

So what is Profitus? How does it work?

Profitus is a crowdfunding and investment platform, an intermediary between investors, who are looking to employ their free money and those who want to receive funding for business ideas and real estate projects.

Our main goal is to make investment available to everyone. Even those who don’t know a lot about investing. Investments start at 100 euros and the platform is open 24/7. Investments are secured by pledging real estate, as well as by other collaterals (e.g., indemnity or warranty). Different projects have different security tools that users can access in self-service for each project.

Profitus selects and places on the website projects to which investors are invited to invest according to the terms and conditions set out in the description. Investors are mortgaged with real estate and paid interest on the project, which is a guarantee that their investment will be repaid.

Profitus oversees the borrower’s timely settlement with investors and fully represents the interests of investors. On the other hand, Profitus is a great help for business as it mobilizes funding from a wide range of investors, manages paperwork, and provides a platform for easy reporting to investors.

What are your competitors and competitive advantages?

Profitus’s competitors are other crowdfunding platforms investing in real estate and credit companies.

In borrowing, our strengths are speed, flexibility, and focus. We can quickly mobilize the right amount of money, and we are the only ones in the market to offer staged funding.

From the investors’ point of view, our main asset is knowledge, risk management, and project selection. And, of course, the opportunity to employ money with the average annual interest rate of almost 11 % and get real estate as a guarantee.

What were the reasons behind coming up with this idea and launching this product?

The idea of Profitus developed slowly when I was working with real estate buyers, sellers. More and more people were curious about opportunities to invest their money in real estate but not necessarily large amounts of money. Here is where the idea of Profitus was born – to unite people and give them the opportunity to invest small amounts of money in real estate, to become partners in real estate projects or to implement their own real estate projects.

When exactly did you launch, what were the main challenges before launching?

We opened our marketplace on the 8th of August 2018. We managed to achieve great results and become the youngest and one of the leading participants in the Lithuanian market.

One of the hardest things was to form a team that had a lot of knowledge and experience in both real estate and financial technology, but we succeeded.

What are your target customers? Both in terms of user profile and geography?

The Profitus platform brings together investors and customers who want to borrow. As a result, one of our target customer group consists of small and medium businesses that want to borrow and possess real estate to pledge and another group includes individuals or entrepreneurs looking for opportunities to employ their free money.

As far as the territory is concerned, we are currently providing loans only to businesses located in Lithuania, but we plan to expand abroad this year. As for investors, it is possible to invest across the EU through the platform.

What are the main challenges while working on this product and how are you overcoming them?

One of the major challenges in the financial field is to earn the trust that we constantly build with our high-quality work and openness. We publish information about our activities and projects. We do a considerable amount of educational activities related to investing and crowdfunding.

Another challenge is technology. As being a technology-driven business, we need to constantly invest in technology development and improve the platform. We have formed our company’s IT team that is currently developing the platform technology, which is an ongoing process. Most likely, such a day when everything is completed will never come and new challenges will always be present.

How are you funded? Do you seek extra funding?

Until now, all investments in business development have come from businesses previously created by Profitus founders – me (Viktorija Vanagė) and Mindaugas Vanagas. However, we are currently considering opportunities for obtaining around 1 million euros from risk capital.

Please introduce your founders, your core team and your broader team?

Currently, the only founders and shareholders are me (Viktorija Vanagė) and Mindaugas Vanagas.

Mindaugas acts as a board member and consultant. He also runs the previously established real estate development company CITUS.

Meanwhile, I’m the head of Profitus and i’m focusing on platform development.

Also I’m a Co-founder of asset management company Victory Funds and real estate development company CITUS.

As far as the team is concerned, it employs top-level market experts with extensive work experience. Each of them is crucial to the company.

How has business been so far? Could you share some numbers to illustrate this (users, sales, etc)?

Since our launch on the 8th of August 2018 the platform crowdfunded 9.4 million euros and funded 55 projects in total. It is because of these achievements that eu-startup.com has named Profitus as one of the ten most promising startups in Lithuania to be followed in 2020.

Profitus investors have already earned more than 334,000 euros through the platform and investors are offered to employ money through the platform at an average annual rate of 10.65 %.

Currently, Profitus has more then 5,000 registered investors, with a loan-to-value (LTV) ratio averaging only 51 %.

In 2019, the platform funded only projects in Lithuania, but it also accepts investments from across the European Union. Although Profitus offers an investment starting from 100 euros, the average investor portfolio currently stands at 10,374 euros and the average investment is 2,437 euros.

Future plans, ambitions? Simply speaking – what’s next?

By the end of this year, we will seek to fund projects worth 33 million euros. To achieve this, of course, we need to go into other markets and not just look for investors, but also finance projects. So, we plan to invest in the development abroad in 2020.

We also intend to offer new loan products to business customers and more investment opportunities for investors. Of course, the technical development of the platform is also very important. We intend to introduce the secondary loan market and the option of investment sweep. A new version of the platform, which will be even more user-friendly, is already in the making.

Thank you for your answers!