Startup Of The Week: Dealoyal

2017

Oct 16

Oct 16

Meet Odeta Isevičiūtė, Co-founder and CMO of Dealoyal – a first cash back app linked directly to a user’s bank card. While it is an innovative marketing tool for businesses, it allows customers to get cash back for everyday purchases without any effort. In this interview Odeta reveals more about the startup and its operations.

So what is Dealoyal? How it works?

How many times have you forgotten your “loyalty” or discount card at home? Or how many times did you receive irrelevant offers from various businesses?

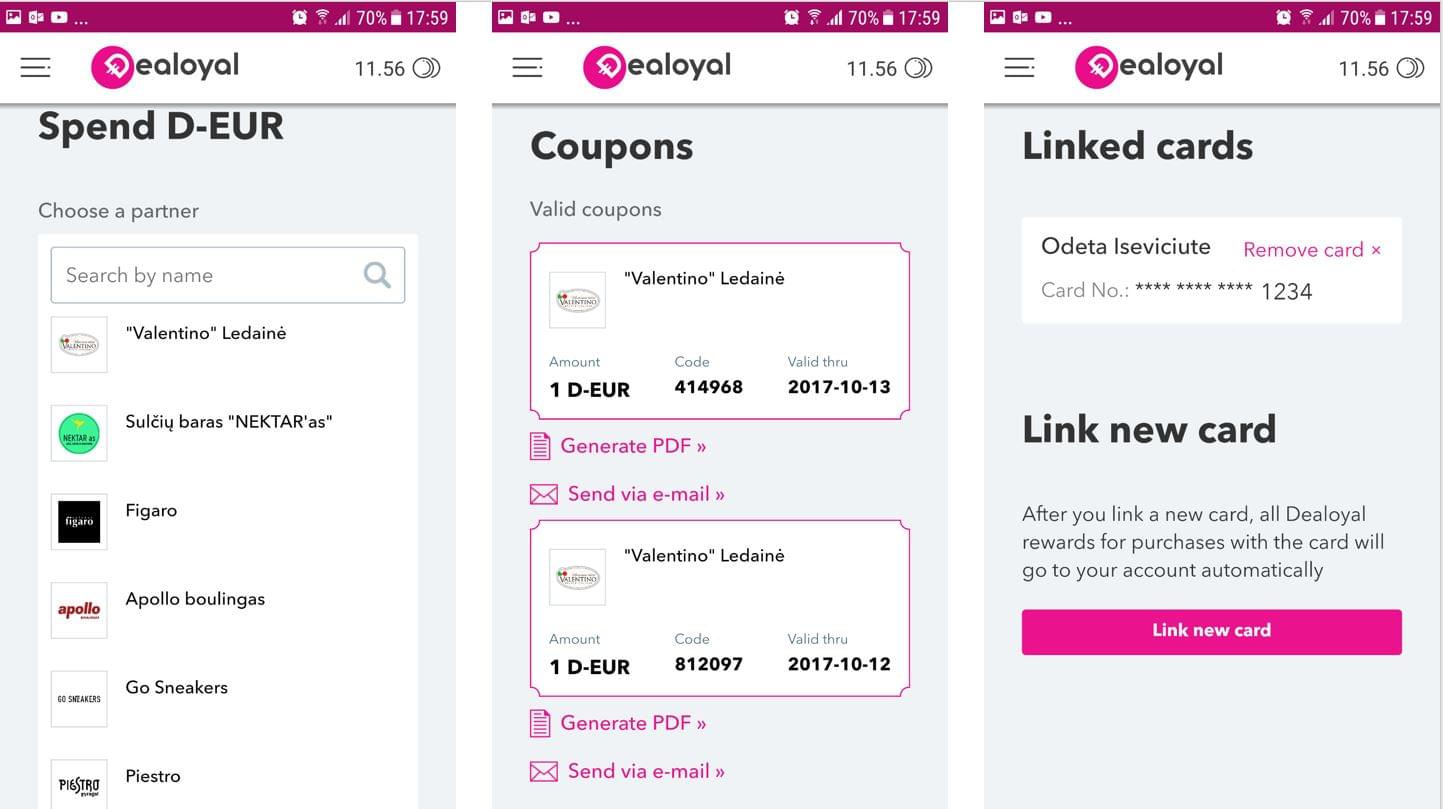

Dealoyal is the first cashback app linked directly to a user’s bank card. Forget extra plastic cards. With us you always get the most relevant offers because our cashback applies to the whole bill rather than certain products. On top of that, you never forget to claim your offers as offers apply every time you pay by a registered bank card.

There are many online cashback marketplaces, not so many offline and non that links directly to a user’s back card. Everybody is tired of multiple loyalty cards tiering our wallets, but to date there has been no solution to address this problem at scale.

To address this problem we have developed an effortless system for both businesses and users alike. Simply register your bank card on Dealoyal, pay by a registered bank card at our partner stores and all offers will apply automatically. No extra effort for cashier or consumer.

We could even say that all our partner offers are available on our users’ bank cards. For convenience, it’s possible to add multiple bank cards from any bank, so Dealoyal is not restricted to certain banks.

In the background we’re working to make sure that all users get individual offers based on their preferences and consumption habits and our offers are as personal as possible.

What are your competitors and competitive advantages?

On one hand, any well executed loyalty program could be seen as our competition, typically big retailers, gas stations, airlines or credit cards have such programs. Our key competitive advantage over this group is the marketplace and also exclusive offers that are larger than just 1 or 2%.

On the other hand, we have offline cashback marketplaces. Our competitive advantages here are numerous starting with effortless integration and application, technology, data analysis and user segmentation from business perspective, all the way through to being 100% effortless from user’s perspective.

What were the reasons behind coming up with this idea and launching this product?

The three co-founders had different ideas on how to extend digital data analytics to offline as there is a clear gap in the market. It is a bit crazy that at this digital age companies are still giving out plastic loyalty cards and worse, not really doing anything with them expect giving a discount. We came together and after some polishing we have what Dealoyal is today – an offline data based platform.

When exactly did you launch, what were the main challenges before launching?

The minimum viable product with few partners was out in June 2015.

Our integrations with bank card reader software providers are very complex, expensive and time consuming. It was a real challenge to work out the first infrastructure and get in the door with software providers. Once that was done the next challenge was to convince our first partners to join and put their offers on Dealoyal while there were no users. We are grateful to those who did and still remain with us today like Valentino ledai and Nektaras.

What are main challenges while working on this product and how are you overcoming them?

Our concept is new in the region to both users and businesses, hence education to both directions is key.

Good example is that some businesses don’t want to join Dealoyal because some other businesses are already with us. This issue is very specific to smaller markets like Lithuania. Biggest online cash back platforms in the UK, US and Scandinavia partner with almost every business in that respective market. It is most important to understand what Dealoyal can do to your own business and not look at who else is there. This isn’t a collision or partnership between businesses. We are a marketing tool and the more businesses are on the platform, the more users will use it, so the better it will be to everyone involved.

How are you funded? Do you seek extra funding?

We are backed by Nextury Ventures and four business angels from USA and Lithuania, Nextury Ventures is our angel inventor. Currently we’re looking to expand into the Nordics and we will be looking for series A investment once this stage begins.

Congratulations with partnership with SEB! What encouraged you to make this deal with the bank? How do you see users reactions so far?

It was clear from the very beginning that trying to onboard companies to join Dealoyal and attract users on our own will take a very very long time – a luxury that we didn’t have. So we did what all startups do – be creative and bold. We needed a partner who will help us to solve at least one of these challenges at scale. In the meantime, SEB is always looking for innovative solutions that help it’s small and medium sized businesses. So it was right timing and mutual interests that brought us together and has helped through a long process of negotiations to signing a contract.

Users are very positive about our partnership. The number of Dealoyal users have more than tripled since we announced our partnership. So in just 1.5 months we have grown more than we did in one and a half years up to that. Such a credible bank like SEB is the best big brother a company like Dealoyal could have.

Please introduce your founders, your core team and your broader team?

Paulius Valatkevicius is a co-founder and CEO. Prior to Dealoyal Paulius co-founded dalinuosi.lt and worked as a CEO at Livinage, online advertising agency.

Ernestas Zvaigzdinas is a co-founder and CPO. Ernestas is a serial entrepreneur mostly known for his work at MobilityBee, Propusher, Asound and other startups.

Odeta Iseviciute is a co-founder and CMO. Odeta gained her marketing experience working globally with companies like Groupon, New York Times, Expedia and many more.

Akvile Zelnyte is our community manager. She has been working and interning with startups in Portugal and Lithuania ever since she started university.

How has business been so far? Could you share some numbers to illustrate this (users, sales, etc)?

We are currently focusing on growth in terms of users and partners. Since we announced our partnership with SEB Bank Dealoyal has more than doubled across both. Our goal is to onboard 100 000 users by the end of the year and we are well on track to achieve it. We have also recently signed contracts with 11 new businesses and will soon launch their first offers.

It’s like the chicken and the egg thing where if users come, businesses follow and visa versa.

Future plans, ambitions? Simply speaking – what’s next?

Very simply continuous growth here in Lithuania and internationally. Expansion to 2-3 big European markets are the next steps which we hope will happen sooner rather than later.

Thank you, Odeta, for this interview!