Startup Of The Week: CoinGate

2017

Jul 10

Jul 10

CoinGate is a Bitcoin payments company. Their specialty is software solutions that give an extremely easy way for online businesses and retail shops to accept payments in the digital currency Bitcoin. Dmitrijus Borisenka is Chief Executive Officer who introduces CoinGate to us.

So what is Coin Gate? How it works?

CoinGate is a Bitcoin payments company, enabling businesses and merchants to accept payments from a global customer base, risk-free. Today Bitcoin adoption is still relatively low since it has become largely a trading asset; however, in the long run I see it solving at least a couple of major problems in the FinTech world – cross-border and online payments.

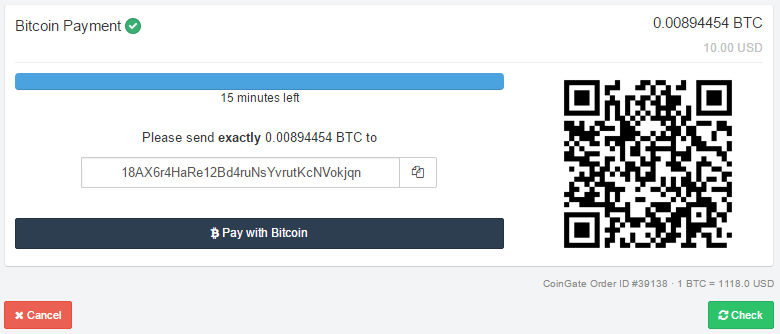

That is essentialy what our company does. CoinGate is a payment gateway that connects businesses with their customers using our system of invoices. Bitcoin payments made by customers are connected with the store via our API, and the business can manage their paid orders on our platform. We are connected to several Bitcoin exchanges, and so we eliminate the risk of Bitcoin volatility for businesses by guaranteeing a fixed payment for each order straight to their bank account.

What are your competitors and competitive advantages?

Although there is a growing number of businesses involved in Bitcoin payments, we see them not as competitors but rather peers. Compared to credit cards, PayPal and other mainstream payment methods, there are so many companies that do not yet accept Bitcoin payments, that there is no need for any of the Bitcoin companies to compete on snapping companies away from each others noses.

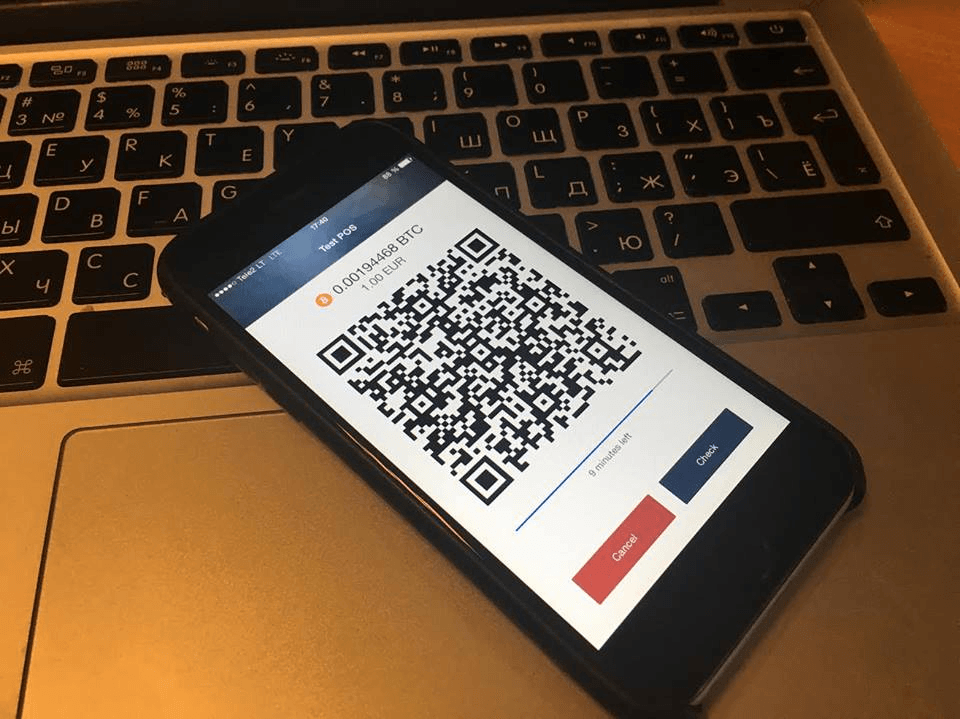

Nevertheless, I can confidently say that we do have advantages over our competitors. We have been deeply involved in the feedback loop with our clients and so we have tailored our gateway so that it is convenient and understandable both for businesses, and for their customers. Using Bitcoin for payments is still a relatively new thing to most people, and so it is important to make the process as simple as possible to both sides. We have thus extended our API functionality to make it hardly possible for an inexperienced user to mess something up. In the meantime, businesses can sit back and relax because, apart from processing their products, they do not have to be involved in the payment process – we have it in our hands all the way from checkout, to payment, to customer support.

What were the reasons behind coming up with this idea and launching this product?

We decided to become part of the Bitcoin and Blockchain revolution after realizing that Bitcoin brought something extraordinary with its seemingly effortless way of bypassing any unnecessary intermediaries when making peer-to-peer payments. The benefits are obvious for both the customer side and the business side. On the one hand, we were really excited about the potential of bringing the control of money back to the people. Bitcoin is a first of its kind method of payment that works as a pull rather than a push method. Contrary to card payments, no one can ever deduct money from a user’s Bitcoin wallet, because he is always in control of it. For businesses, Bitcoin brings a risk-free way of accepting payments from global customer base. Bitcoin transactions cannot be charged back, and, equally importantly, they are quite cheap.

From our point of view, these benefits should, in due time, allow Bitcoin payments to achieve universal adoption, and we believed that it would be a great idea to have a working service ready when Bitcoin goes mainstream.

When exactly did you launch, what were the main challenges before launching?

We started building the CoinGate platform from scratch in 2014, yet another year was spent on shaping and formulating how the whole concept should work. There were very little resources at the time on the technology, so it was really a „come on let’s make it happen“ product, and we had to learn a lot about numerous peculiarities of how Bitcoin works at a deep level. We started actively onboarding customers as well as expanding our range of services to cryptocurrency trading in 2015. Being pioneers in Blockchain business did not come without its pressures and questions from banks, press and various state entities back in the year 2014, but the attitudes are shifting and our home country is finally getting the idea of the potential behind decentralized ecosystems.

What are your target customers? Both in terms of user profile and geography?

For our payment processing service, the ideal client is a business that delivers its products or services to a global customer base. It does not matter too much what the product is as long as there is a wide enough audience that is interested in the product. To date our biggest customers are IT businesses, such as hosting and VPN providers – simply because technical customers are more likely to be already using Bitcoin for payments.

Speaking of geography, it would be incorrect to say that we are limiting ourselves to specific regions, as we already have clients from the UK, the Netherlands, Germany, Spain, Russia, India, Hong Kong, and UAE, among other countries.

What are main challenges while working on this product and how are you overcoming them?

The regulatory vacuum on crypto-currencies has been the primary source of uncertainty to us. Bitcoin is still not regulated properly by the EU, and is therefore seen as a “high risk” industry. This leads to slower adoption from the state-related entities and commercial banks, which in reality should become key partners to companies such as ours.

Operating on such unstable grounds makes it is difficult to reach and commit to agreements, as well as to dedicate fully and responsibly to a project, when you cannot be certain that the partners you depend on will deliver their promises. Therefore we are working hard on implementing contingency plans and getting as many different financial partners as possible, through continuous education on crypto-currencies, EU regulations and our business model.

How are you funded? Do you seek extra funding?

CoinGate is privately funded by the founders. At the moment we do not see the need for external funding neither in 2017 nor in the upcoming year, unless our business model will expand to other alternative payment methods – we are still uncertain about it.

Please introduce your founders, your core team and your broader team?

Our founders list consists of myself – CEO Dmitrijus Borisenka, our CFO Jonas Gilys, Lead Developer Irmantas Bačiulis and IT security specialist Tadas Žeruolis. I can proudly introduce my CTO, Rytis Bieliauskas, one of the best and most knowledgeable experts of Bitcoin and Blockchain. All ongoing operations and sales activities are in the hands of Vilius Semėnas, Veronika Mishura, and Justinas Paulius. We also have a RUBY expert Tomas Achmedovas, junior developers Arnas Fomenko and Justina Žlabytė. The team now consists of 10 and we are constantly hiring new people.

How has business been so far? Could you share some numbers to illustrate this (users, sales, etc)?

We are really seeing that Bitcoin payments are gaining traction for both businesses and customers, especially this year. Back in May we have reached several big milestones: 25,000 paid orders processed on our gateway and 10,000 users registered on our platform. Things have been going really quickly this year – we pretty much grew tenfold, from a couple of dozen orders a day in Autumn of last year, to 250 a day today. In the first 6 months of 2017, we processed over $4,000,000 worth of payments for our clients.

Future plans, ambitions? Simply speaking – what’s next?

Today we have the knowledge, a rapidly expanding customer base and already what we think is a reputable brand name. Actually, the trust we have gained so far within the crypto ecosystem is the biggest achievement for myself and my team. We want to build on this and continue expanding our services to cater an even wider range of businesses and industries.

We see a bright future for Bitcoin and other cryptocurrencies, because they bring a ton of added value to businesses and their customers, despite the fact that most still fail to see this yet. We are seeing a steady organic growth and interest from all kinds of businesses, including gaming and gambling industries as well as payment service providers (IPSPs). These particular markets are very interesting to us, and we plan to expand our range of merchant services to allow such businesses to adopt Bitcoin payments in a frictionless way.

Thank you, Dmitrijus!